“In school we learn that mistakes are bad, and we are punished for making them. Yet, if you look at the way humans are designed to learn, we learn by making mistakes. We learn to walk by falling down. If we never fell down, we would never walk.”

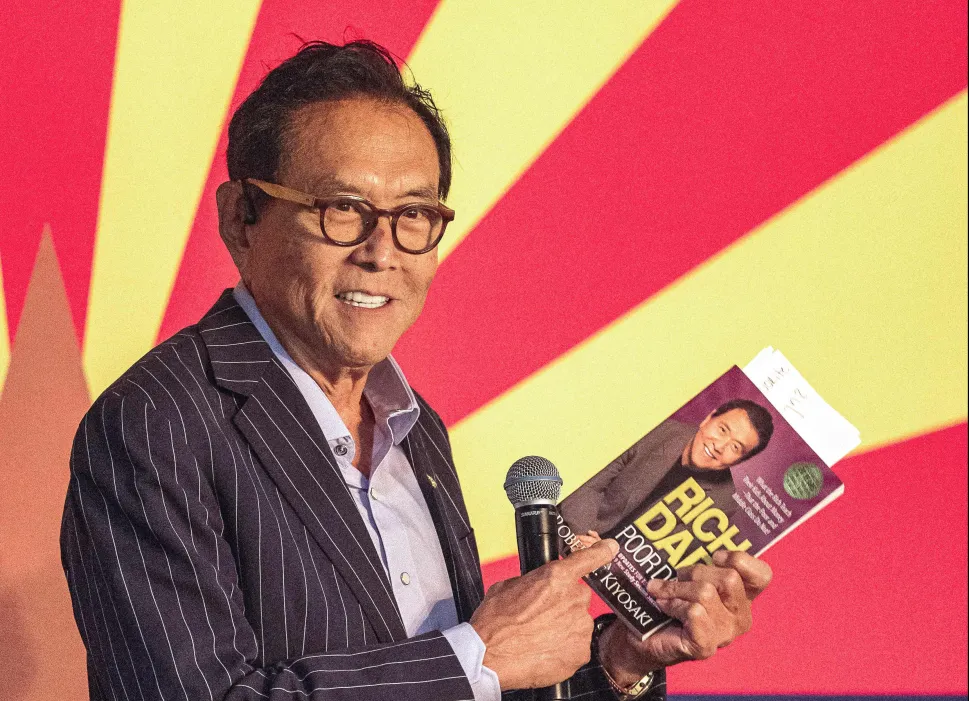

The classical book written by Robert T. Kiyosaki in 1997 gives the basics of financial literacy and also shows the importance of leaving your comfort zone and taking the risks required to reach most of your desires. Here are some lessons I took from the book:

- Understand accounting?

- Improve investment skills?

- Learn how the market acts?

- Know the legislation and law⚖️

Congratulations! As this blog follows the brevity principle(quality of being brief), you are at the second level!?

Before diving into those points, let’s mention how the author showed the way we should act in relation to money and risk-taking. The main difference between rich and poor people is the ability to manage emotions. The author assumes rich people can manage emotions, and they do not decide on feelings but on their minds. Being mind focused also helps to solve problems and leave comfort zones. Let’s imagine one of the difficult cases in our lives public speaking. Here is how he approaches those moments.

“It is said that the fear of public speaking is a fear greater than death for most people. According to psychiatrists, the fear of public speaking is caused by the fear of ostracism, the fear of standing out, the fear of criticism, fear of ridicule, the fear of being an outcast. THE FEAR OF BEING DIFFERENT PREVENTS MOST PEOPLE FROM SEEKING NEW WAYS TO SOLVE THEIR PROBLEMS.”

*Ostracism – Exclusion from a society or group /Oxford Languages

After understanding the necessity of risk-taking, another difference is Rich people see money as just a vehicle or tool. They make money working for them. However, poor people only work to get money. Therefore, most of them become a slave to money. It is like a game or a show, it will go on, and you should know how to dance.

“Winners are not afraid of losing. But losers are. Failure is part of the process of success. People who avoid failure also avoid success.”

Wow, you are at the third level. Let’s play a game!? I bet you will read till the end. I trust you!?

Understand accounting?

Most people can not understand the difference between Assets and Liabilities. The basics of accounting will never hurt.

When we spend money, we think about how useful it is for us and how the item will satisfy our feelings.

For example, let’s imagine a car. Is it an asset?

– No, unless it is not for collection or is scarce. Then, what is it?

– It is probably a liability you should pay for maintenance, oil, possible fines, and design elements.

Financial literacy is simple in most cases. Reading Financial Statements and skill it understanding it will help with achieving personal and business goals.

Improve investment skills?

Ability to make money with money. It is a kind of art, and in order to involve in the process requires creativity. There are various ways of investment, means as real estate, commodities, stocks, and businesses, mentioned in the book. Also, the author encourages readers to increase their financial education and intelligence by reading books, attending seminars, playing games, and seeking mentors.

Learn how the market acts?

Market demand is generated by us humans. The driving force of changes in the market is our emotions. The word emotion comes from energy in motion. Rich people can analyze how communities, societies, individuals, and companies’ emotions shape the market. Seeing trends is also a good example of building strong, long-lasting strategies. One example, human beings are lazy, and building products to solve this issue brings enormous wealth to good market investigator entrepreneurs.

Know the legislation and law⚖️

One of the topics that Rich Dad Poor Dad covers is the importance of understanding legislation and law for financial success. The book explains how rich people use corporations and taxes to their advantage, while poor and middle-class people pay more taxes and have less control over their money. The book also advises readers to learn about different types of laws, such as contract law, corporate law, securities law, tax law, etc., to protect their assets and increase their cash flow. The book also warns readers about the risks of breaking the law or being ignorant of it, such as lawsuits, fines, penalties, or imprisonment. The book encourages readers to seek professional advice from lawyers and accountants when dealing with legal and financial matters.

If you want to improve your financial situation and create wealth for yourself and your family, this book is a good start. The only possible lack of a book, it is a bit outdated, still many useful tips to check out.

I hope you enjoyed this blog post and learned something valuable from it. If you have any questions or comments about the book or the blog post, please feel free to share them below. I would love to hear from you. Thanks for reading!

Here you can find the book:

Congratulations! You nailed it! I wish you a wonderful day?