In the early stages of a startup, founders may overlook the importance of metrics due to the seemingly insignificant size of their operations. However, these metrics are crucial for several reasons:

- Demand Assessment: Metrics can provide valuable insights into whether there is a market demand for your product or service. They can help you understand your target audience’s needs and preferences, enabling you to tailor your offerings accordingly.

- Pivot Consideration: By tracking key metrics, you can identify when your current strategy isn’t working and a pivot might be necessary. A pivot could involve a change in your product, target audience, business model, or other aspects of your startup.

- Initial Valuation: Metrics play a significant role in determining your startup’s initial valuation. Investors often look at key performance indicators (KPIs) to assess the potential return on their investment.

Remember, while the numbers might seem small in the beginning, they hold the potential to provide powerful insights that can guide a startup’s growth and success. Let’s delve into the heart of essential business metrics. Today, our focus will be on two fundamental yet crucial metrics: Bookings and Revenue. These may seem straightforward, but they are the lifeblood of a thriving business.

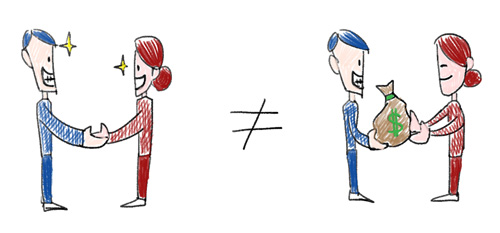

Bookings vs. Revenue

Sometimes, they are used interchangeably, but they have different meanings.

Bookings is the value of a contract between the company and the customer. It reflects a contractual obligation on the part of the customer to pay the company.

Revenue is recognized when the service is actually provided or ratably over the life of the subscription agreement.

Letters of intent and verbal agreements are neither revenue nor bookings. However, they could be shown as initial tracking.

Recurring revenue vs. Total revenue Investors more highly value companies where the majority of total revenue comes from product revenue (vs. from services). Why? Services revenue is non-recurring, has much lower margins, and is less scalable. Product revenue is the what you generate from the sale of the software or product itself.

ARR (annual recurring revenue) is a measure of revenue components that are recurring in nature. It should exclude one-time (non-recurring) fees and professional service fees. ARR per customer: Is this flat or growing? If you are upselling or cross-selling your customers, then it should be growing, which is a positive indicator for a healthy business. MRR (monthly recurring revenue): Often, people will multiply one month’s all-in bookings by 12 to get to ARR.

Common mistakes with this method include: (1) counting non-recurring fees such as hardware, setup, installation, professional services/ consulting agreements; (2) counting bookings.

Gross Profit

Gross profit is a crucial metric that investors use to gauge the profitability of a company’s revenue stream. It’s not just about the growth in top-line bookings, but also about how profitable that revenue is.

Gross profit generally includes all costs associated with the production, delivery, and support of a product or service. However, the specifics of what’s included in gross profit can vary from one company to another.

Therefore, it’s essential to be ready to provide a detailed breakdown of what constitutes that gross profit figure. This includes clarifying what costs are included in, and what costs are excluded from, the gross profit calculation.

Remember, if you can not measure it, you can not improve it. So, keep a close eye on these metrics, understand what they signify, and use them to steer your startup towards success. Happy entrepreneuring! ?

Have a nice day?